Global Capital Markets Have Added Over $11 Trillion Since Trump's Election

Since President Trump's election, global equity markets have added more absolute value than at any time in history (around $12 trillion) - surpassing the front-running exuberance that started when Bernanke hinted at QE2 in 2010.

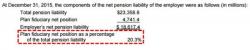

The value of global equity markets reached a record high $76.28 trillion yesterday, up a shocking 18.6% since President Trump was elected. This is the same surge in global stocks that was seen as the market front-ran QE2 and QE3