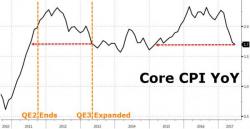

Consumer Prices Disappoint For 4th Month In A Row - Weakest Since Jan 2015

For the 4th month in a row, CPI missed expectations (unchanged MoM vs expectations of a modest 0.1% rise). Across the board consumer price rises disappointed economists' guesses with Core CPI tumbling to just 1.7% YoY - the lowest since Jan 2015...

Energy prices fell 1.6% MoM and were the biggest drag on CPI; Apparel and Transportation (airfares) also fell MoM.

The last time CPI followed this trajectory, Bernanke unleased QE-infinity...

But this time The Fed is hiking rates?