Mortgage Applications Plunge As Rate-Hike Craters Refis

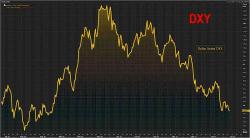

Who could have seen this coming? US mortage applications tumbled 7.4% in the prior week - the biggest drop since 2016 - as mortgage rates rose to two-month highs following the Fed's rate-hike and hawkish jawboning.

The big driver was refis which fell 13% WoW and a stunning 57% year-over-year - the biggest plunge since the taper tantrum.

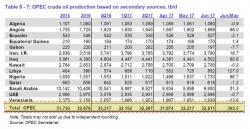

All data above adjusted for July 4th holiday.