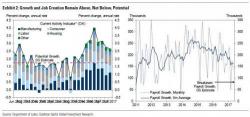

Goldman Looks For Policy Error At The Fed, Finds Something Unexpected

When it comes to Goldman's reaction (function) to the Fed's own reaction function, so to speak, it has been a love-hate, but mostly confused, relationship over the past three months.

First, back in March, Goldman's Jan Hatzius was stunned to note that the market reaction following the Fed's first rate hike was not the reaction the Fed wanted, when "the Fed's 0.25% rate hike had the same effect as a 0.25% race cut" and prompted it to ask if Yellen has lost control of the market.