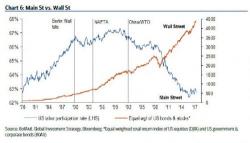

Did Central Bankers Just Light the Fuse on the $217 TRILLION Debt Bomb?

As we noted yesterday, the world’s Central Banks have begun sending signals that the price of money in the financial system (bond yields) is going to be rising.

Why is this a big deal?

Because globally the world has packed on $68 TRILLION in debt since 2007. And ALL of this was issued based on the assumption that bond yields would be remaining at or near record lows.

The bad news?

They’re not. Already we’re beginning to see bond yields RISE.