'Teflon' Tech Stocks Bounce Despite The Biggest Outflows Since 2007

Every effort was made to stomp VIX to lift stocks ahead of The FOMC...

Every effort was made to stomp VIX to lift stocks ahead of The FOMC...

Authored by Simon Black via SovereignMan.com,

What I’m about to tell you isn’t some wild conspiracy. Or fake news. It’s raw fact, based on publicly available data from the US Federal Reserve.

This data shows a very simple but concerning trend: banks in the United States are becoming less safe. Again.

And they’re doing it on purpose. Again.

Few people ever give much thought to the safety and security of their bank.

Authored by Mike Shedlock via MishTalk.com,

Bloomberg reports Subprime Auto Bonds From 2015 May End Up Worst Ever, Fitch Says. I suggest 2017 will be worse, but let’s tune into Fitch first.

Subprime auto bonds issued in 2015 are by one key measure on track to become the worst performing in the history of car-loan securitizations, according to Fitch Ratings.

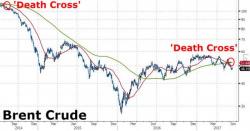

For the first time since September 2014, after which oil prices collapsed almost 75%, Brent and WTI Crude futures both just flashed a 'death cross' signal as the 50-day moving-average crossed below the 200-day moving-average.

The crossover is typically seen a loss of short-term momentum and last occurred in the second half of 2014, when prices collapsed due to oversupply amid surging U.S. shale oil production.

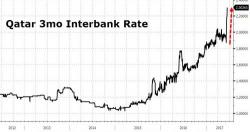

While the Saudi-led campaign to starve Qatar's citizens may end up short of the target, with both Turkey and Iran volunteering to provide needed staples to the isolated Gulf nation while local entrepreneurs have started a cow paradropping campaign to offset the decline in milk imports, a more pressing problem has emerged: Qatar's financial system is running out of dollars. As Bloomberg reports, several Qatari banks have boosted interest rates on dollar deposits to shore up liquidity as the Saudi-led campaign to isolate the gas-rich Arab state intensifies.