SocGen: "This Is What Happens When The Algos All Head For The Exit At The Same Time"

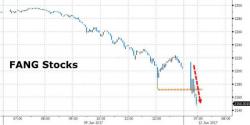

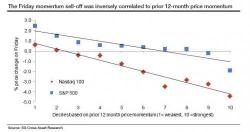

After Goldman, JPM and even Dennis Gartman all opined on Friday's "tech wreck", in which the Nasdaq tumbled 2% as the Dow Jones hit new all time highs (the only previous time it has done that was in 1999 just as the tech bubble was ramping up), and when the Philly semiconductor index fell 4.2%, SocGen's Andrew Lapthorne could not resist, and in a note released on Monday morning, explains that what happened on Friday was merely an episode of "systematic momentum selling", or said otherwise, a teaser of what happens when the algos all "head for the door all at the sam