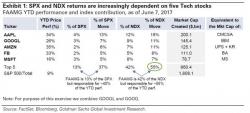

Goldman: "The Last Time The Market Acted Like This Was At The Tech Bubble Peak"

Yesterday's dramatic "rotational" divergence between tech stocks and the rest of the market, which as Sentiment Trader pointed out the only time in history when the Dow Jones closed at a new all time high while the Nasdaq dropped 2% was on April 14, 1999, stunned many and prompted Bloomberg to write that "a crack has finally formed in the foundation of the U.S. bull market. Now investors must decide if any structural damage has been done."