Debt Has No Consequences? Color Us Skeptical

Authored by Charles Hugh Smith via OfTwoMinds blog,

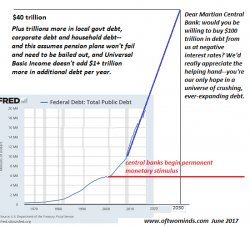

The entire status quo is based on the delusion that rapidly rising debt will never generate any negative consequences.

Authored by Charles Hugh Smith via OfTwoMinds blog,

The entire status quo is based on the delusion that rapidly rising debt will never generate any negative consequences.

At the end of May, we highlighted that after an unprecedented buying spree, which has sent the Nasdaq to nosebleed record levels, a crack had appeared in the second tech bubble: after weeks of relentless inflows into the sector, tech had suffered its largest outflow in over a year.

Paul Singer just became the latest investing luminary to warn that the unprecedented monetary stimulus adopted by the Federal Reserve and other major central banks in Europe and Asia has elevated market risks to their highest levels since before the great financial crisis.

“I am very concerned about where we are,” Singer said Wednesday at the Bloomberg Invest New York summit.

As the world awaited "Thundering Thursday" and all its potential for panic... this happened in the markets...(NSFW)

While stock markets remain comfortably numb to any and every potential (and actual) geopolitical earthquake, FX markets are getting very anxious...

Polls showing the Conservative Party has lost its comfortable lead have increased uncertainty over today’s U.K. election and investors are now paying the price.