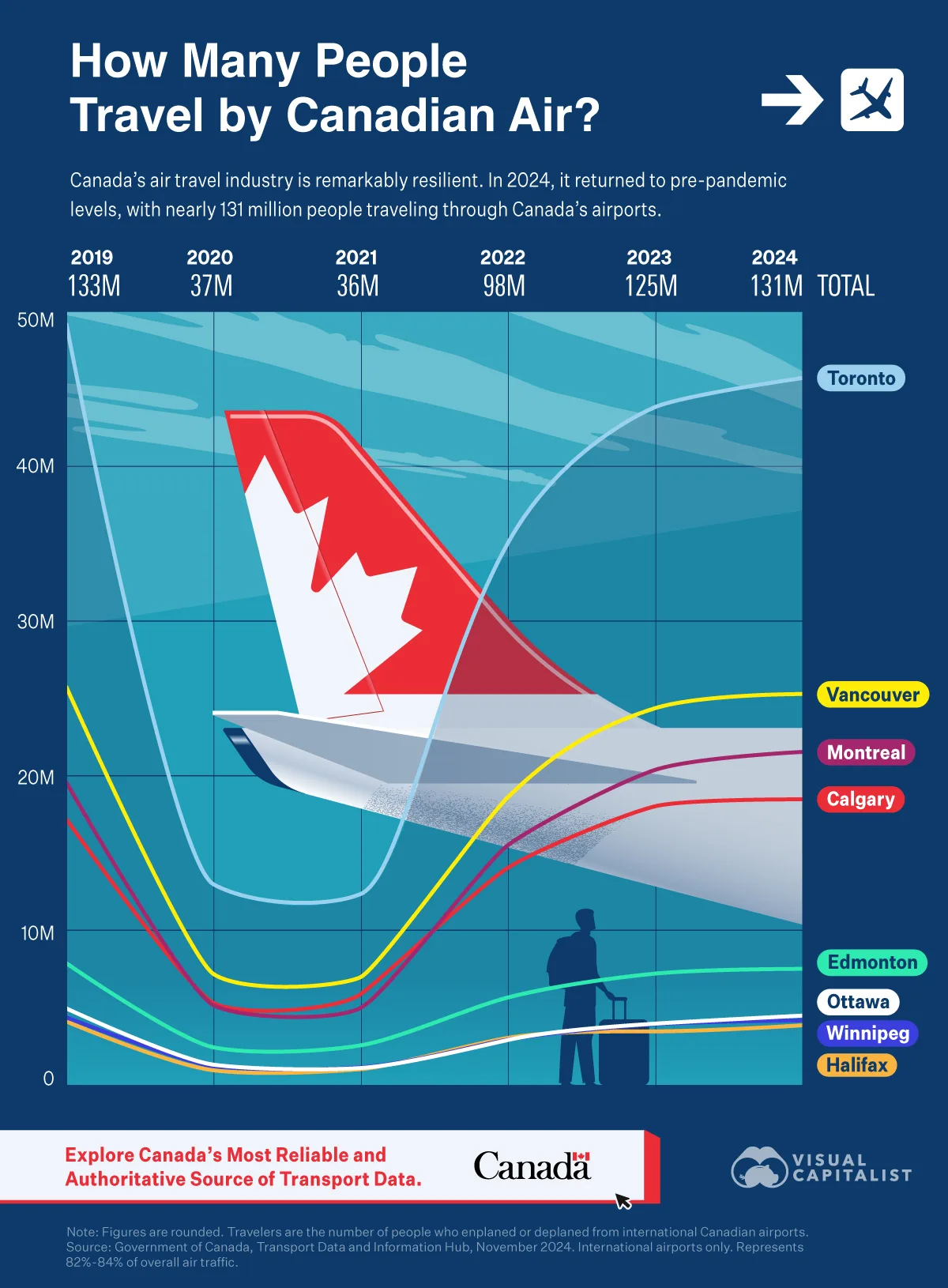

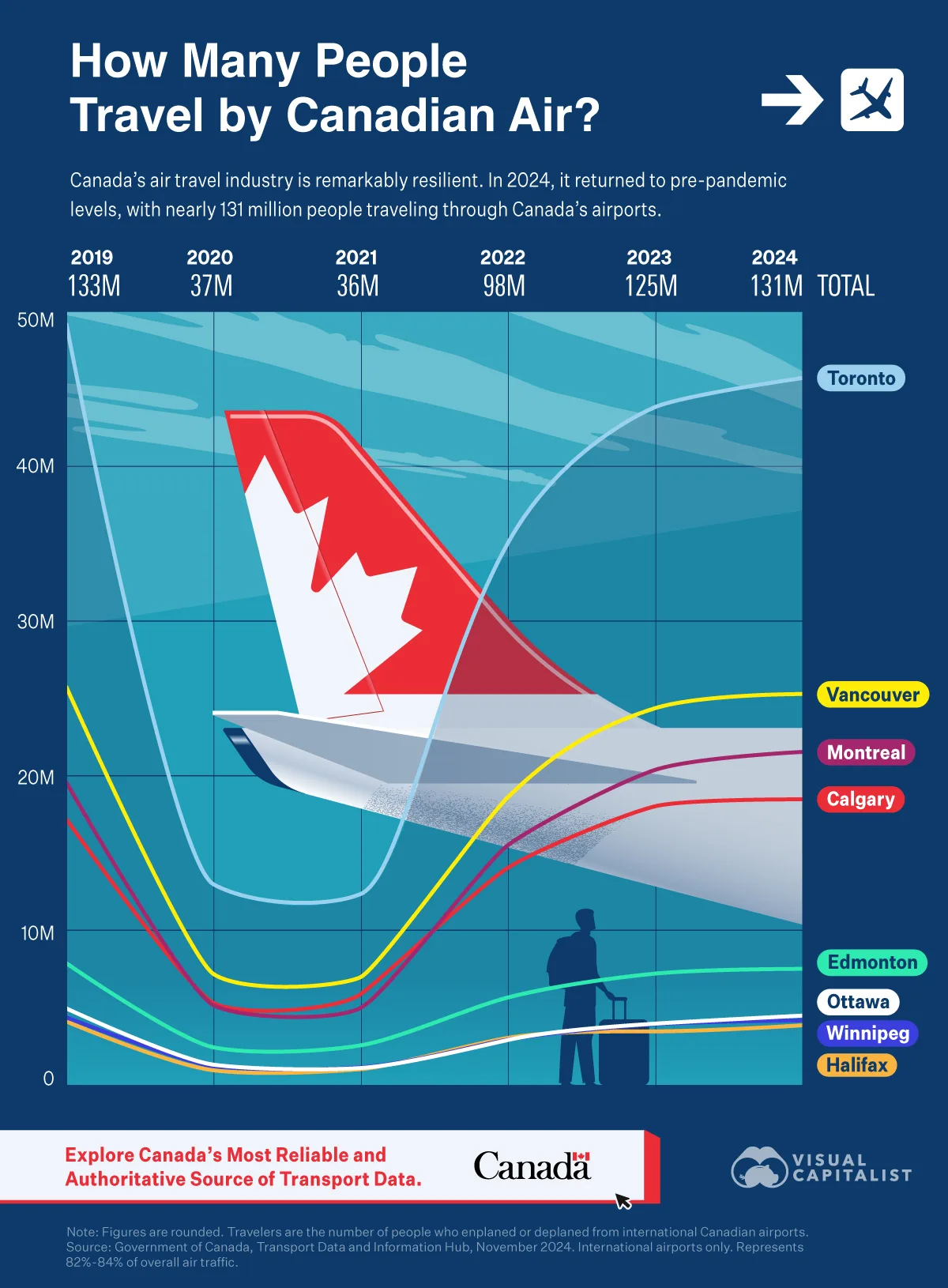

How Many People Travel by Canadian Air?

Published

57 minutes ago

on

October 17, 2025

| 332 views

-->

By

Ryan Bellefontaine

Graphics & Design

Published

57 minutes ago

on

October 17, 2025

| 332 views

-->

By

Ryan Bellefontaine

Graphics & Design

Published

12 seconds ago

on

October 7, 2025

| 153 views

-->

By

Alan Kennedy

Article & Editing

Graphics & Design

Published

1 hour ago

on

September 24, 2025

| 32 views

-->

By

Alan Kennedy

Article & Editing

Graphics & Design

![]()

See this visualization first on the Voronoi app.

Use This Visualization

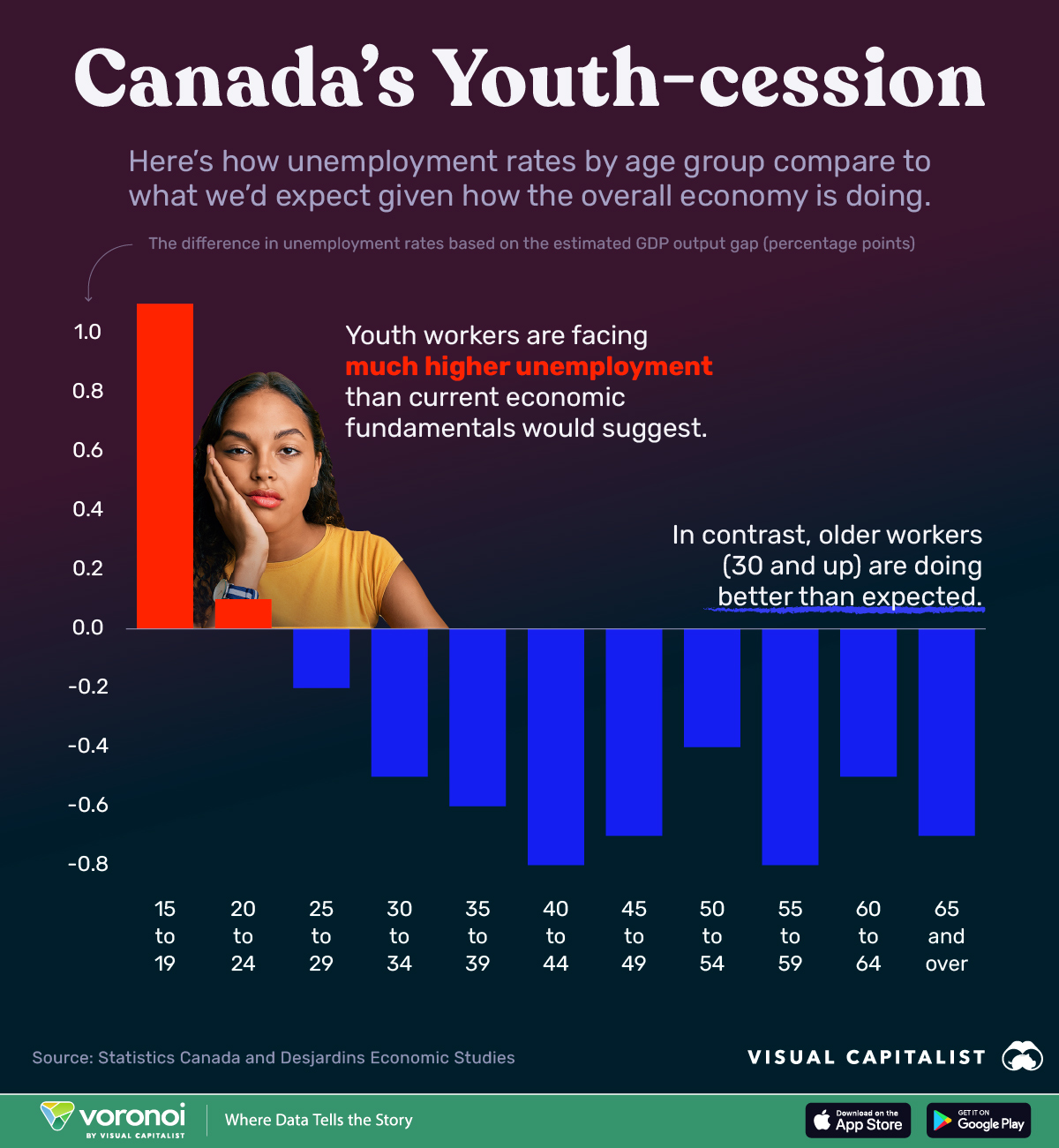

Canada’s Gen Z Workforce Hit Hardest by Economic Uncertainty

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.