China’s Response to the Neocon Warmongers

China’s Response to the Neocon Warmongers

https://www.rt.com/news/340359-china-test-ballistic-missile/

The post China’s Response to the Neocon Warmongers appeared first on PaulCraigRoberts.org.

China’s Response to the Neocon Warmongers

https://www.rt.com/news/340359-china-test-ballistic-missile/

The post China’s Response to the Neocon Warmongers appeared first on PaulCraigRoberts.org.

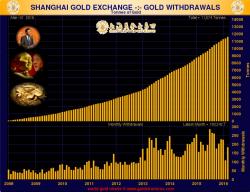

China Gold Yuan Trading To Boost Power In Gold and FX Markets – End Manipulation?

China launched yuan denominated gold bullion trading today in a move that will further boost its power in the global gold and fx markets. Critics of the existing pricing mechanisms hope that it will lead to increased transparency and may end price manipulation.

Authored by Paul Craig Roberts,

When Ronald Reagan turned his back on the neoconservatives, fired them, and had some of them prosecuted, his administration was free of their evil influence, and President Reagan negotiated the end of the Cold War with Soviet President Gorbachev. The military/security complex, the CIA, and the neocons were very much against ending the Cold War as their budgets, power, and ideology were threatened by the prospect of peace between the two nuclear superpowers.

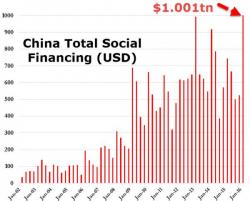

A week ago we highlight the "last bubble standing" was finally bursting, and as China's corporate bond bubble deflates rapidly, it appears investors are catching on to the contagion possibilities this may involve as one analyst warns "the cost has built up in the form of corporate credit risks and bank risks for the whole economy." As Bloomberg reports, local issuers have canceled 61.9 billion yuan ($9.6 billion) of bond sales in April alone, and Standard & Poor’s is cutting its assessment of Chinese firms at a pace unseen since 2003.

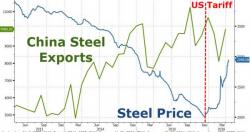

A funny thing happened when US slapped a major tariff on China's steel exports... prices exploded higher. But the almost 50% surge in steel prices since mid-December back to 15-month highs have left traders equally split on what happens next.