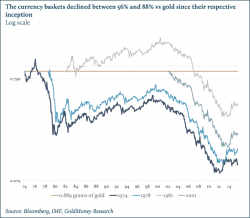

The IMF’s Special Drawing Rights, the RMB and gold

The IMF’s Special Drawing Rights, the RMB and gold

The full article with additional charts and tables is published

on GoldMoney.com can be downloaded

here.

The IMF’s Special Drawing Rights, the RMB and gold

The full article with additional charts and tables is published

on GoldMoney.com can be downloaded

here.

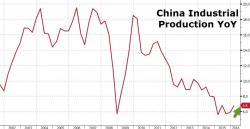

Heading into tonight's datagasm from China, SHCOMP tumbled and Yuan was strengthening (while money-market rates were ticking higher). Then it began... Retail Sales BEAT (+10.5% vs. +10.4% exp), Industrial Production BEAT (+6.8% vs. +5.9% exp), Fixed Asset Investment BEAT (+10.7 vs. +10.4% exp) and last - but not least - GDP MEET (+6.7 vs. +6.7% exp) - though still the weakest since Q1 2009. The post-data reaction was initially opsitive but then faded fast as reality hit on the lack of stimulus coming.

Two days ago we introduced you to "the rich kids of Vancouver" for whom the most important decision in any given day is whether to spend half a million dollars on a new Lamborghini or on an investment such as "two expensive watches or some diamonds."

From left, Loretta Lai, Chelsea Jiang and Diana Wang attended a receptionat a Lamborghini dealership last month in Vancouver, British Columbia

China has condemned the United States’ Human Rights record at home and abroad in an annual report released on Thursday. U.S. politics is corrupted by money and nepotism, with numerous wars in the Middle East providing a glimpse of how the U.S. government views “lives in other countries as worthless,” according to the scathing Chinese Human Rights report.

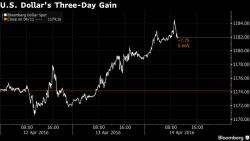

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt.