China Embraces Gold In Advance Of Post-Dollar Era

Submitted by Koos Jansen via AllChinaReview.com,

Submitted by Koos Jansen via AllChinaReview.com,

Submitted by Pater Tenebrarum via Acting-Man.com,

Economic and Demographic Changes

In January we pointed out "the last bubble standing," as China's crashing equity market had spurred massive inflows - directed by a "well-meaning" central-planning committee's propaganda - sparking a massive bubble in Chinese corporate bond markets (in an effort to enable desperately weak balance-sheet firms to roll/refi their debt and keep the zombies alive). That has now ended as China's junk bond risk has soared to 5-month highs with its worst selloff since 2014. As HFT warns, "we should avoid junk bonds."

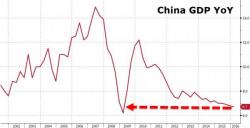

When China reported its economic data dump last night which was modestly better than expected (one has to marvel at China's phenomenal ability to calculate its GDP just two weeks after the quarter ended - not even the Bureau of Economic Analysis is that fast), the investing community could finally exhale: after all, the biggest source of "global" instability for the Fed appears to have been neutralized.

Good news is still bad news after all.

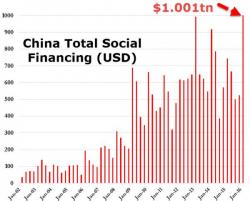

After last night's China 6.7% GDP print which while the lowest since Q1 2009, was in line with expectations, coupled with beats in IP, Fixed Asset Investment and Retail Sales (on the back of $1 trillion in total financing in Q1)...