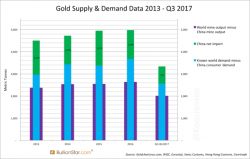

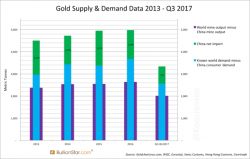

China Gold Import Jan-Sep 777t. Who’s Supplying?

Submitted by Koos Jansen, BullionStar.com.

Submitted by Koos Jansen, BullionStar.com.

Just days ahead of this weekend's Guangzhou Auto Show, Volkswagen has announced plans to invest $12 billion dollars into efforts to build coal-fueled electric vehicles in China. According the Wall Street Journal, VW plans to produce 400,000 EVs by 2020 and introduce 5 new all-electric models each year through 2025.

Volkswagen AG and its Chinese partners will jointly invest nearly $12 billion by 2025 in developing electric cars for the local market, VW’s China chief executive said.

After five consecutive daily losses on the MSCI world stock index and seven straight falls in Europe, there was finally a bounce, as investors returned to global equity markets in an optimistic mood on Thursday, sending US futures higher after several days of losses as global stocks rebounded following a Chinese commodity-driven rout.

Yang Xiadou is the Party’s number two man in Xi Jinping’s crackdown on corruption in the Chinese Communist Party – although some have seen this, in part, as a convenient way for Xi to bolster his power base.

Authored by Antonius Aquinas via Acting-Man.com,

Expensive Politics

Instead of a demonstration of its overwhelming military might intended to intimidate tiny North Korea and pressure China to lean on its defiant communist neighbor, President Trump and the West should try to learn a few things from China.

President Trump meets President Xi. The POTUS reportedly had a very good time in China. [PT]