Frontrunning: June 21

- Republican Handel Wins Georgia House Seat, Dashing Democrats’ Hopes (BBG)

- Uber CEO Kalanick Quits as Investors Revolt (WSJ)

- Saudi King’s Surprise Shakeup Clears Son’s Path to the Throne (BBG)

- After weeks of secrecy, U.S. Senate to unveil healthcare bill (Reuters)

- Latest Election-Hacking Hearings to Focus on State-Level Events (WSJ)

- Trump’s Net Worth Slips to $2.9 Billion as Towers Underperform (BBG)

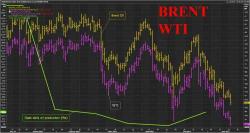

- Oil Returns to Bear Market (WSJ)

- Brexit Dominates May's Program as Some Manifesto Pledges Ditched (BBG)