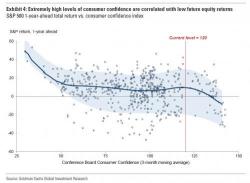

The Chart That's Keeping Goldman Up At Night

The spread between "hard" and "soft", or survey and sentiment data, ever since the election has been extensively noted and discussed on this website in recent months (especially since over the past two months the soft data has rolled decisively over, while the Citi economic surprise index has crashed at the fastest pace on record). Which is why it will come as no surprise to readers that, as Goldman writes in a note looking at "Peak Sentiment", over the past six months, US “sentiment surveys” have outpaced both “activity surveys” and “hard data”.