CalPERS Weighs Pros/Cons Of Setting Reasonable Return Targets Vs. Maintaining Ponzi Scheme

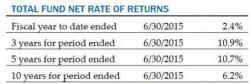

In just a couple of months, the largest pension fund in the United States, the California Public Employees' Retirement System (CalPERS), will have to decide whether they'll rely on sound financial judgement and math to set their rate of return expectations going forward or whether they'll cave to political pressure to maintain artificially high return hurdles that they'll never meet but help to maintain their ponzi scheme a little longer. The decision faced by CALPERS is whether their long-term assumed rate of return on assets should be lowered from the cu