The Coming Economic Downturn In Canada

Authored by Deb Shaw via MarketsNow.com,

Authored by Deb Shaw via MarketsNow.com,

Authored by Kevin Muir via The Macro Tourist blog,

Usually when CFTC data shows a big speculative position, it is easy to spot the corresponding mood amongst traders. For example, take the current situation with the Canadian dollar. There are record net speculative shorts, and that bias is obvious amongst hedge funds and other professional traders.

However, over the past few years, I have been puzzled by the building of a massive record net long speculative position in the WTI crude oil market.

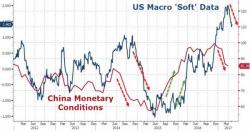

"Something is off," warns RBC's head of cross-asset strategy Charlie McElligott in the introduction to his latest market noting that the swing in US fiscal policy optimism is coming at a critical time as the China's liquidity tightening is spooking the reflation story.

SUMMARY:

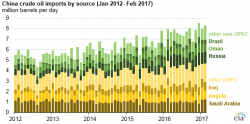

China is the world’s largest net importer of crude oil, and in recent years, China’s crude oil imports have increasingly come from countries outside the Organization of the Petroleum Exporting Countries (OPEC). As the EIA reports in a recent blog post, while OPEC countries still made up most (57%) of China’s 7.6 million barrels per day (b/d) of crude oil imports in 2016, crude oil from non-OPEC countries made up 65% of the growth in China’s imports between 2012 and 2016. Leading non-OPEC suppliers included Russia (14% of total imports), Oman (9%), and Brazil (5%).

Something unprecedented happened last November when OPEC sat down in Vienna to hammer out the final terms of its oil production cut deal (which, incidentally, has yet to translate into a drop of all time high inventories): one day before the summit, the oil producing cartel - or rather Saudi Arabia - secretly invited hedge funds to sit in on the negotiations and provide OPEC, with input on what to do.