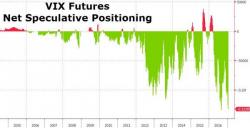

Raoul Pal Warns The Day Of Reckoning Looms For VIX Shorts: "Reminds Me Of Portfolio Insurance In 1987"

ubmitted by Patrick Ceresna via Macrovoices.com,

In a podcast interview on MacroVoices, Macro Guru Raoul Pal makes some comments on some of the biggest imbalances in the markets today.

He compares the VIX contango trade to the portfolio insurance problem that was blamed for the 1987 crash...