Worst US Economy Since Government Shutdown Sparks Panic-Buying In Stocks

Well, we've seen some ridiculous moves in markets before but today's cross asset-class malarkey takes the proverbial biscuit...

Or put another way...

Well, we've seen some ridiculous moves in markets before but today's cross asset-class malarkey takes the proverbial biscuit...

Or put another way...

Via NorthmanTrader.com,

Submitted by Lance Roberts via RealInvestmentAdvice.com,

That didn’t take much. After a three-day rally, the media is back into “bullish” mode suggesting the bottom is likely in and by the end of this year, it’s all going to be just fine.

https://player.cnbc.com/p/gZWlPC/cnbc_global

Submitted by Brandon Smith via Alt-Market.com,

Normalcy bias is a rather horrifying thing. It is so frightening because it is so final; much like death, there is simply no coming back. Rather than a physical death, normalcy bias represents the death of reason and simple observation. It is the death of the mind and cognitive thought instead of the death of the body.

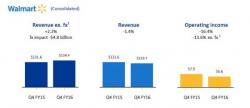

Moments ago the world's largest retailer by workers (if not by market cap any more courtesy of AMZN), reported non-GAAP earnings which at $1.49/share in Q4 beat expectations of $1.46 (GAAP missed at $1.43 but let's ignore that). The company also announced that comp sales at Walmart U.S. were positive for the fifth consecutive quarter, up 1.5% with traffic increasing 1.7%.