Peak Economic Delusion Signals Coming Crisis

Authored by Brandon Smith via Alt-Market.com,

Authored by Brandon Smith via Alt-Market.com,

Economic data at 2-year lows, rate hikes, and hawkish outlook... yield curve crash, FANG (growth) plunge, and Gold down...

First things first - today's macro data was an utter disaster and smashed Citi Surprise Index to its lowest in 2 years...

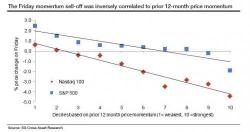

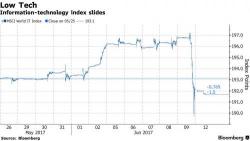

After Goldman, JPM and even Dennis Gartman all opined on Friday's "tech wreck", in which the Nasdaq tumbled 2% as the Dow Jones hit new all time highs (the only previous time it has done that was in 1999 just as the tech bubble was ramping up), and when the Philly semiconductor index fell 4.2%, SocGen's Andrew Lapthorne could not resist, and in a note released on Monday morning, explains that what happened on Friday was merely an episode of "systematic momentum selling", or said otherwise, a teaser of what happens when the algos all "head for the door all at the sam

First the bad news: following Friday's "tech wreck" European equity markets have opened lower, with the Stoxx 600 sliding 0.9% and back under the 50DMA for the first time since December, dragged by selloff in tech shares, mirroring Asian markets as Friday’s "FAAMG" volatility in U.S. markets spreads globally, battering shares from South Korea to the Netherlands.

The following article by David Haggith was first published on The Great Recession Blog:

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a purge begun for the tech stocks that have driven the nation’s third-longest bull market?