Don`t Be The Dow 20,000 Retail Sucker! (Video)

By EconMatters

By EconMatters

For evidence that the market bears are all but extinct look no further than the latest letter from erstwhile bear Bob Janjuah, in which the Nomura strategist throws in the towel in a near-term correction and predicts that "the trends over H1 2017 should be higher (especially US) equities and yields, steeper curves, a stronger USD, and mixed performance in credit (especially in the IG sphere) and EM.

Authored by Scott Kristoff via Avondale Asset Management,

We started this year with the economy deteriorating and finished it with the second interest rate increase in ten years. There were a lot of ups and downs along the way, but ultimately 2016 was defined by three key story-lines: 1) Brexit 2) The Presidential Election 3) Fed Policy.

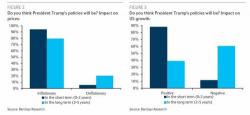

While the majority of sellside analysts predict that the impact of Trump's fiscal stimulus policies will be largely beneficial for US inflation and economic growth, if only in the short-term, with a knock on reverse effect following shortly after...

... one prominent strategist disagrees.

According to a recent report from Gluskin Sheff's David Rosenberg, in which he lays out is "out-of-the-box" call for 2017, "Trump will accidentally engineer a return to the disinflation trade" in the coming year, well ahead of most expectations.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Dow 20,000

Last week, I noted the market’s push toward the market milestone of 20,000. To wit:

“The Dow broke above 19700 and is within striking distance of the ‘psychological’ summit of 20,000. With just 250 points to go, it is extremely likely traders will try and push stocks to that level by Christmas. Woo Hoo!”