Dow Dumps Into Red For May As Oil Fails To Hold $50

Having tried (and failed) twice to hold $50, WTI Crude futures plunged back into the red as machines ran out of stops to churn. This triggered another notable leg lower in stocks, slamming The Dow into the red for May... Gold and bond are best since the Friday close.

Which slammed The Dow into the red for the month..

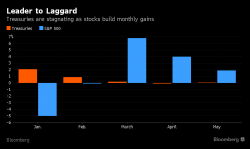

As gold is once again the best performer since the close before the long weekend...