Stocks Dump, Bonds Jump As Retail Wreckage Trumps Crude Spike

Remember how awesome it all felt yesterday, yeah that's all gone... Pride (in senseless uncorrelated low volume rallies) always comes before the fall...

Remember how awesome it all felt yesterday, yeah that's all gone... Pride (in senseless uncorrelated low volume rallies) always comes before the fall...

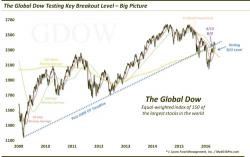

Via Dana Lyons' Tumblr,

A key global equity index is testing its significant breakout level from last month.

Submitted by Simon Black via SovereignMan.com,

There’s something about being insanely rich that people will believe every word that comes out of your mouth no matter how bizarre.

And no, I’m not talking about Donald Trump. Warren Buffett is an even better example.

As one of the richest men in the world, Buffett’s opinions carry almost Biblical impact, even when they might be completely ridiculous.

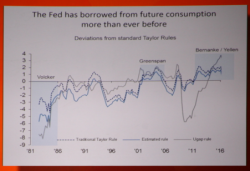

If anyone had wondered if Stanley Druckenmiller's recent bearishness had dissipated, or transformed into at least modest bullishness as a result of the market meltup, we have bad news.

Moments ago at the Sohn Conference, Druckenmiller raged at the Federal Reserve's dire monetary policies, saying that low interest rates have caused an environment where "not a week goes by without someone extolling the virtues of the equity market." The obsession with short term stimulus contrasts with the monetary reform of 80's which led to the bull market, he added.

Despite his proclamation that he "saved the world from a Great Depression," the fact is that Obama will be the first President ever to not see a single year of 3% GDP growth - but only cynical fiction-peddlers would mention facts at a time like this.