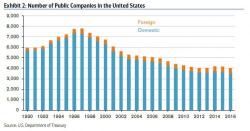

Where US Stocks Are Traded Today

Last week, the US Treasury Department issued its second of four reports related to President Trump’s Executive Order 13772 (on regulation in alignment with the Core Principles). The first report was on Banking, this report is on the Capital Markets, and other reports will follow over the coming months (including on asset management, insurance, products, vehicles, non-bank financial institutions, financial technology, financial innovation, and others).