Germany Sees Surge In Stabbings And Knife Crimes

Authored by Soeren Kern via The Gatestone Institute,

Authored by Soeren Kern via The Gatestone Institute,

Authored by Pepe Escobar via The Asia Times,

France's president is lauded in the media for talking tough with his Russian counterpart, but behind the hype may be signs of a new alignment...

The three-hour face-off between Vladimir Putin and Emmanuel Macron in Versailles offered some fascinating geopolitical shadow play.

Authored by James Durso via OilPrice.com,

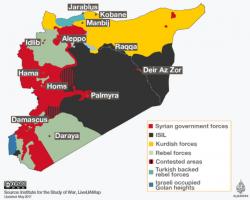

It’s the 101st anniversary of the Sykes–Picot Agreement and, in light of the non-stop Syrian Civil War, it’s time to ask, “How’s that working out for you?”

It's official: there is nothing in this world that Russian hackers can't do.

* * *

In an opportune coincidence, when discussing the Qatar crisis earlier today, we laid out the "official narrative" behind the dramatic fallout in diplomacy between Qatar and Saudi Arabia.

In what has emerged as the most significant escalation to result from the Qatar diplomatic crisis - which pits two of OPEC’s largest oil producers, Saudi Arabia and the UAE, against the world’s biggest exporter of liquefied natural gas and further disrupts stability in the region - the biggest Middle East oil and container ports banned all vessels sailing to and from Qatar from using their facilities.