In Watershed Event, Europe Unveils Plan To Securitize Sovereign Debt

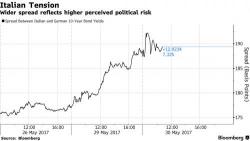

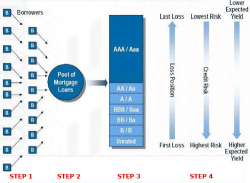

Less than a decade after various complex, synthetic, squared, cubed and so on securitized debt structures nearly brought down the financial system, here come "Sovereign Bond-Backed Securities."

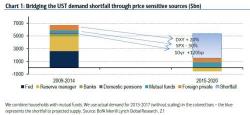

Moments ago, the FT reported that in a watershed event for the European - and global - bond markets, Brussels is pressing for sovereign debt from across the eurozone to be "bundled into a new financial instrument and sold to investors as part of a proposal to strengthen the single currency area."

Call it securitized sovereign debt.