If Vol-Neutrals Are Finally Liquidating, Could They Crash The Market? Here Is The Math

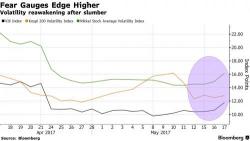

It was just over two months ago - well before VIX hit its record stretch of nearly 20 days below 11 - when we first discussed why one of the major threats to the complacent market was the danger of a forced liquidation by trend-following and vol-neutral, CTA, risk-arb and other systematic funds - many of whom have been the fundamental catalyst for the unprecedented VIX compression seen in May - resulting in an explosive unwind of vol positions.