French Establishment Mount The Ramparts Against Le Pen

Authored by Finian Cunningham via The Strategic Culture Foundation,

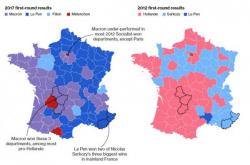

«Centrist» candidate Emmanuel Macron was no sooner announced winner in the first round of the French presidential election at the weekend, and with unseemly haste the political establishment rushed to close ranks against rival Marine Le Pen of the Front National.