A Delighted Wall Street Reacts To The French Election

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

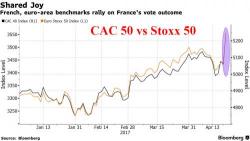

Risk is definitely on this morning as European shares soar, led by French stocks and a new record high in Germany's Dax, after a "French relief rally" in which the first round of the country’s presidential elections prompted investors to bet that establishment candidate Emmanuel Macron will win a runoff vote next month, and who is seen as a 61% to 39% favorite to defeat Le Pen according to the latest just released Opinionway poll.

For those who may have missed yesterday's events, here is a quick recap from DB:

The risk of a Eurozone breakdown now appears to be taken off the table after a French election that has led to a dramatic repricing in European risk assets. And yet the outcome - which was largely expected - has prompted Bloomberg's Richard Bresow to muse just how much was truly priced in:

Authored by Mike Shedlock via MishTalk.com,

Project Syndicate writer, Hans-Werner Sinn, explains why the ECB’s asset purchases and Target2 imbalances constitute “Europe’s Secret Bailout”.

Under the ECB’s QE program, which started in March 2015, eurozone members’ central banks buy private market securities for €1.74 trillion ($1.84 trillion), with more than €1.4 trillion to be used to purchase their own countries’ government debt.

Authored by Finian Cunningham via The Strategic Culture Foundation,

Russian President Vladimir Putin addressed the International Arctic Forum this week on the real and present dangers from falsifying history. He said such deliberate distortion of history erodes international law and order, creating chaos and leading to further conflict.