Fitch Downgrades Italy To BBB From BBB+

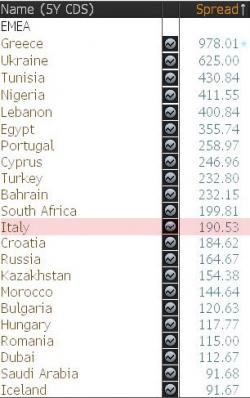

Having largely disappeared from the market's scope for the past 6 months, ever since Europe "bent" its rule allowing the bailout of Monte Paschi and several smaller banks despite Italy having the greatest amount of disclosed NPLs of any European nation, moments ago Fitch decided to drag Italy right back in the spotlight when it downgraded Italy to BBB from BBB+, citing "Italy's persistent track record of fiscal slippage, back-loading of consolidation, weak economic growth, and resulting failure to bring down the very high level of general government debt has left it more exposed to pote