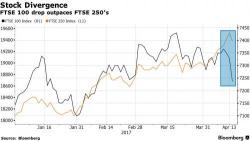

Fund Managers Revolt: Cut Allocation To "Record Overvalued" US Stocks To Lowest Since 2008

Forget the "great rotation" from bonds into stocks - and certainly today when the 10Y dropped as low as 2.175% - a far greater rotation taking place currently is out of the US and into European equities, according to the latest monthly Fund Manager Survey released today by Bank of America.