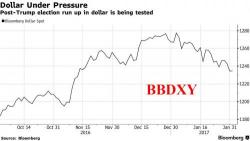

Dollar Slide Accelerates After Fed Fails To Boost Confidence, Pressures US Futures

European shares and S&P futures fell amid mixed earnings from corporate heavyweights, while Asian stocks were fractionally higher. The dollar slump continued against all its major peers after the Federal Reserve gave dollar bulls little to be optimistic about. The U.S. currency dropped toward the lowest close since November after the Fed reiterated its intention on Wednesday to lift rates only gradually.