What Trump Means For Vol Trading: "This Is The Start Of Global Regime Change"

Via Artemis Capital Management,

Via Artemis Capital Management,

Was it really that easy - Buy The Election (hope), Sell The Inauguration (reality)?...

The Dow continues to cling to unchanged for 2017 (small caps red)...

Since the inauguration...

Separate comments last week from European Central Bank President Mario Draghi and Federal Reserve Chair Janet Yellen confirmed an ongoing change in the policy configuration facing their two systemically important central banks: The recognition of a transition in both economic conditions and prospects, along with questions about robustness and durability.

In an overnight note by Goldman's Ian Wright titled "Calm before the storm", which looks at pricing of risk during the current low-vol episode, the GS strategist writes that in the run up to the inauguration last Friday of the 45th President of the US, investors have remained keen to discuss all things at the intersection of President Trump and markets. And yet, despite the uncertainty, volatility has been very low, which is why Goldman tries to estimate which assets appear the most fragile in the event that volatility picks up.

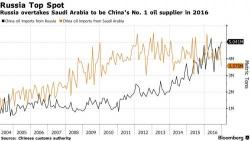

While OPEC members were infighting over crude production and export quotas, posturing with temporary production cuts (just so the Saudis could get a six month reprieve during which it clears out a massive internal crude glut), Russia was busy capturing market share, and according to overnight Chinese data, Russia overtook Saudi Arabia as China’s top oil supplier last year for the first time ever boosted by robust demand from independent Chinese "teapot" refineries.