November To Remember - Unprecedented Month In Markets Ends Weak

What else could we use for today...

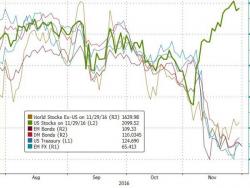

November was quite a month...

What else could we use for today...

November was quite a month...

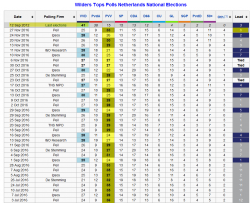

Submitted by Michael Shedlock via MishTalk.com,

The nannycrats in Brussels face yet another attack on the anti-immigration front: Geert Wilders’ Far-Right Party Tops Polls in the Netherlands.

Geert Wilders, chairman of the Party for Freedom (PVV), has been celebrating on Twitter today. The reason? His party is now the biggest party in the Dutch polls. With elections coming up in March 2017, the populist politician seems to be on track to become the Netherlands’ next prime minister.

Submitted by Michael Shedlock via MishTalk.com,

European Commission President, Jean-Claude Juncker issued a warning to Austrian presidential candidate Norbert Hofer, regarding referendums.

Hofer, an anti-immigration, candidate is in a tight race for the election coming up on December 4.

If he wins, Hofer said he would hold in-out referendums if Brussels seeks to expand it power.

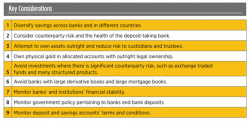

Ulster Bank Parent RBS Fails Bank of England Stress Test

"Royal Bank of Scotland (RBS)(RBS.L) will cut costs and sell assets to boost capital levels, it said on Wednesday after failing this year's Bank of England stress test, which warned of a "challenging" outlook for Britain's financial system.