How To "Pre-Trade" FOMC Days

The biggest movers on FOMC days are the Dollar Index, Investment-grade credit, Homebuilders and Real Estate, according to Goldman Sachs' options strategists.

The biggest movers on FOMC days are the Dollar Index, Investment-grade credit, Homebuilders and Real Estate, according to Goldman Sachs' options strategists.

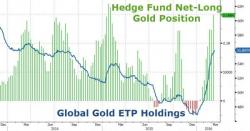

Despite Goldman Sachs "short gold" recommendation - which came within pennies of being stopped out last week - traders, investors, and safe-haven seekers continue to push into the precious metals.

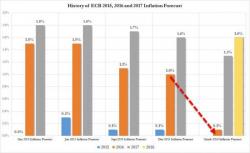

Last week it was all about the ECB, which disappointed on hopes of further rate cuts (leading to the Thursday selloff) but delivered on the delayed realization that the ECB is now greenlighting a tsunami in buybacks (leading to the Friday market surge). This week it is once again all about central banks, only this time instead of stimulus, the risk is to the downside, with the BOJ expected to do nothing at all after the January NIRP fiasco, while the "data dependent" Fed will - if anything - hint at further hawkishness now that the S&P is back over 2,000.

The biggest macro development over the weekend was China's latest "gloomy" economic update, in which industrial production, retail sales and lending figures all missed estimates, however now that we are back to central bank bailout mode, bad news is once again good news, and the Shanghai Comp soared +1.7% among the best performers in Asia on calls for further central bank stimulus while the new CSRC chief also vowed to intervene in stock markets if necessary. In other words, the worse the data in China, the better.