"A Dramatic Escalation Appears Imminent" In Syria

Originally posted at The Saker,

The situation in Syria has reached a watershed moment and a dramatic escalation of the war appears imminent. Let’s look again at how we reached this point.

Originally posted at The Saker,

The situation in Syria has reached a watershed moment and a dramatic escalation of the war appears imminent. Let’s look again at how we reached this point.

How quickly the official narrative changes.

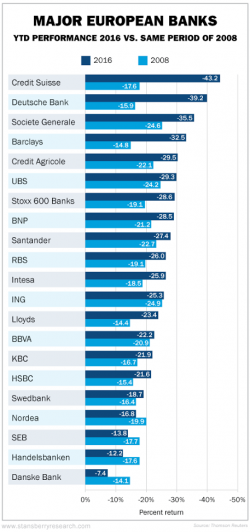

Just several months ago, in October, we reported that the now-rattled largest European bank, Deutsche Bank, boosted its forecast for German 2016 GDP to 1.9% from 1.7% saying that "although the external and the financial environment have deteriorated we have lifted our 2016 GDP call... drivers are stronger real consumption growth due to lower oil prices/stronger EUR and the surge in immigration."

Submitted by Jim Quinn via The Burning Platform blog,

Submitted by Constantin Gurdgiev via True Economics blog,

Global growth leading indicators are screaming it, Baltic Dry Index is screaming it, PMIs are screaming it, BRICS are living it, and now Ifo surveys are showing it: global economy is heading into a storm.

The latest warning is from the Ifo World Economic Climate Index.

Per Ifo release:

Richard Haass warns against “Brexit” and makes an unusually frank admission about why he hopes it doesn’t happen:

Even worse, it is highly probable that Americans advocating for a reduced US role in the world would seize on Brexit as further evidence that traditional allies were not doing their fair share, and that a US facing growing deficits and massive domestic needs should not be expected to make up the difference.