Euro PIIGS Starting To Squeal Again

Via Dana Lyons' Tumblr,

The stock markets of the so-called PIIGS are breaking down on an absolute and relative basis – not a positive development for global markets.

Via Dana Lyons' Tumblr,

The stock markets of the so-called PIIGS are breaking down on an absolute and relative basis – not a positive development for global markets.

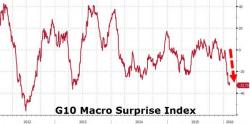

While Citigroup's Eric Lee thinks its "ridiculous" to talk fo a US recession, it appears the macro data and markets would strongly disagree: as Bloomberg reports:

Signals by central banks from Europe to Japan that additional stimulus is at the ready are failing to ease investor concern that global growth will keep slowing.

Yesterday morning, when musing on the day's key event namely Yellen's congressional testimony, we dismissed the most recent bout of European bank euphoria which we said "will be brief if not validated by concrete actions, because while central banks have the luxury of jawboning, commercial banks are actually burning through funds - rapidly at that - and don't have the luxury of hoping for the best while doing nothing." This morning DB has wiped out all of yesterday's gain.

The United States has announced plans to double its military presence in Europe as part of a move to support NATO against increasing “Russian aggression”. The plans are part of the European Reassurance Initiative outlined in the 2017 defense budget, which has been sent to congress for approval. Theepochtimes.com reports: “We’re going to move to a so-called heel to toe basis, where we’re over there consistently on the ground exercising,” said Under Secretary of Defense Mike McCord in a Feb. 9 briefing, according to a transcript.