‘Brexit’ Is Looking More Likely

Tom Goodenough points to new polling that shows the Leave side leading the EU referendum in the U.K.:

Tom Goodenough points to new polling that shows the Leave side leading the EU referendum in the U.K.:

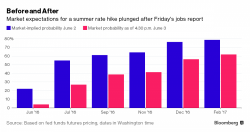

Every ugly nonfarm payrolls has a silver lining, and sure enough following Friday's disastrous jobs report, global mining and energy companies rallied alongside commodities after the jobs data crushed speculation the Fed would raise interest rates this month. “The disappointing U.S. jobs report on Friday means that a summer Fed rate hike is off the table,” said Jens Pedersen, a commodities analyst at Danske Bank. “That has reversed the upwards trend in the dollar, supporting commodities on a broader basis.

Submitted by Soren Kern via The Gatestone Institute,

Opponents counter that the initiative amounts to an assault on free speech in Europe. They say that the European Union's definition of "hate speech" and "incitement to violence" is so vague that it could include virtually anything deemed politically incorrect by European authorities, including criticism of mass migration, Islam or even the EU itself.

After yesterday's two key events, the ECB and OPEC meetings, ended up being major duds, the market is looking at the week's final and perhaps most important event of the week: the May payrolls report to generate some upward volatility and help stocks finally break out of the range they have been caught in for over a year. However, even today's jobs number will likely be skewed as reported previously as a result of the Verizon strike which is said to trim some 35,000 jobs from the headline print, casting anything the BLS reports today in doubt.

There are just two drivers setting the pace for today's risk mood: the OPEC meeting in Vienna which started a few hours ago, and the ECB's announcement as well as Mario Draghi's press statement due out just one hour from now. Both are expected to not reveal any major surprises, with OPEC almost certainly unable to implement a production freeze while the ECB is expected to remain on hold and provide some more details on its corporate bond buying program, although there is some modest risk of upside surprise in either case.