Death Of The Salesmen - Mifid II Strikes Again

Now they tell us…

Now they tell us…

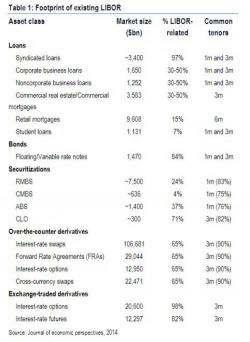

In an unexpected announcement, earlier this week the U.K.'s top regulator, the Financial Conduct Authority which is tasked with overseeing Libor, announced that the world's most important, and manipulated, benchmark rate will be phased out by 2021, catching countless FX, credit, derivative, and other traders by surprise because while much attention had been given to possible LIBOR alternatives across the globe (in a time when the credibility of the Libor was non-existent) this was the first time an end date had been suggested for the global benchmark, which as we explained

For years, bankers and buysiders assumed that moving away from conventional messanging services like AOL or the ubiquitous Bloomberg Chat to discuss confidential information, would spare them the attention of regulators and enforcers. That, however, changed today when the UK regulator, the Financial Conduct Authority imposed a fine of £37,198 on a former Jefferies banker for sharing confidential client information over WhatsApp. "The FCA found that Mr Niehaus failed to act with due skill, care and diligence."

Two former Deutsche Bank corporate brokers have been sentenced to one of the longest prison terms possible for the crime of insider trading in the UK.

Just two days after Deutsche Bank fired the head of its "integrity committee", Georg Thoma who had been originally tasked with clearing up the bank's past scandals, because according to DB's vice chairman Alfred Herling, Thoma had been "overzealous" and "goes too far when he demands ever wider investigations and more and more lawyers come marching up", today the UK financial watchdog agency FCA announced that Germany's biggest bank has "serious" and "systemic" failings in its controls against money laundering, terrorist financing and sanctions, the Financial Times reported.