Full Preview Of Tomorrow's "Historic" FOMC Meeting

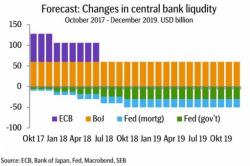

It is virtually guaranteed that tomorrow the FOMC will make history by officially announcing the Fed's plan to begin shrinking its balance sheet through the gradual phasing out of bond reinvestments, which however in a world in which other central banks continue to pump $125 billion per month, will hardly by noticed by markets at least in the beginning.