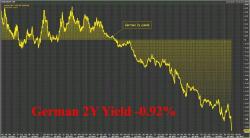

Blow Out In German 2Y Bonds Sends Yield Crashing To Record Low As Political Fears Grow

The ongoing scramble for German safety away from French political uncertainty, has led to yet another blow out day for German 2 Year Schatz, with the yield tumbling to a fresh all time low of -0.92%, as Eurozone breakup concerns have spread from the bond market, and are now pressuring the euro sending the EURUSD below 1.05 for the first time in over a month.

The rush into German paper and out of France, means that the 10Y Greman-French spread has topped 0.8%, the widest in over four years, while the 2Y US-German spread is now well over 2%, the widest since at least 2000.