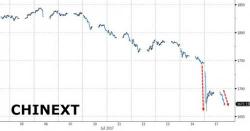

Chinese Corporate Financials Continue Disturbing Trend Of Deterioration

Authored by Bryce Coward via Knowledge Leaders Capital blog,

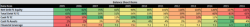

Highlighting the deteriorating trend in Chinese corporate financials has been an annual feature our of this blog. This year, instead of looking at just the CSI 300 constituents, we chose to broaden our universe by using the FTSE All A Share Index, an index of about 2000 Chinese A shares. This should give us the most accurate read on the state of corporate China.