A Stunned Wall Street Reacts To UK's Hung Parliament

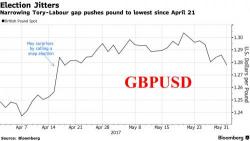

It was supposed be a UK general election that solidified Conservative dominance, and boosted Brexit leverage. It ended up being the opposite, after British voters delivered a stinging rebuke to Prime Minister Theresa May and her ruling Conservative party, depriving her of a majority, resulting in a "hung parliament" and thrusting the country back into a new period of uncertainty as it prepares to depart from the European Union.

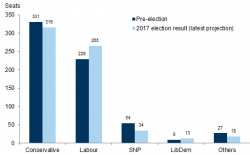

A quick recap of what happened overnight: