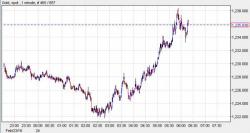

Gold Rose Another 10% In February – Best Month Since January 2012

Gold Rose Another 10% In February – Best Month Since January 2012

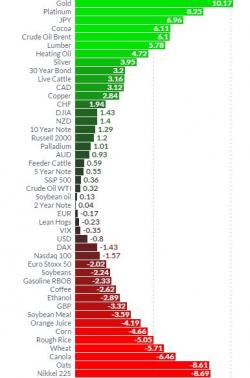

Gold bullion rose 10.1% in February adding to the 7% gains seen in January. This means that gold is the best performing asset this year, up 17% so far in 2016. Silver is the next best performing asset with an 8% gain year to date, followed by US Treasuries (30 Year Bond) which have gained 7.8% so far in 2016.