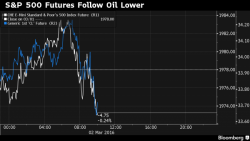

Futures Lower On Lack Of China Stimulus; Oil Squeeze Continues; Gold Spikes Ahead Of ECB

In the aftermath of last week's disappointing G-20 Shanghai summit, there was much riding on this weekend's start of the China's People's Congress, and specifically what if any stimulus announcement Beijing will make; sadly for stimulus addicts China mostly disappointed and after the unimaginative scope of growth proposals, it is hardly surprising that European stocks and US equity futures have taken a leg lower, even if Chinese stocks rose and certain commodities such as Iron Ore soared overnight on hopes China will either "rationalize" capacity or at least build some more roads to nowhere