On Opex Day, It's All About The Dollar: Futures, Oil Levitate As USD Weakness Persists

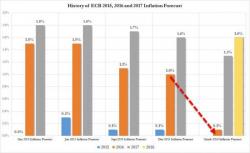

It may be option expiration day (always leading to abnormal market activity) but it remains all about the weak dollar, which after crashing in the two days after the Fed's surprisingly dovish statement has put both the ECB and the BOJ in the very awkward position that shortly after both banks have drastically eased, the Euro and the Yen are now trading stronger relative to the dollar versus prior.