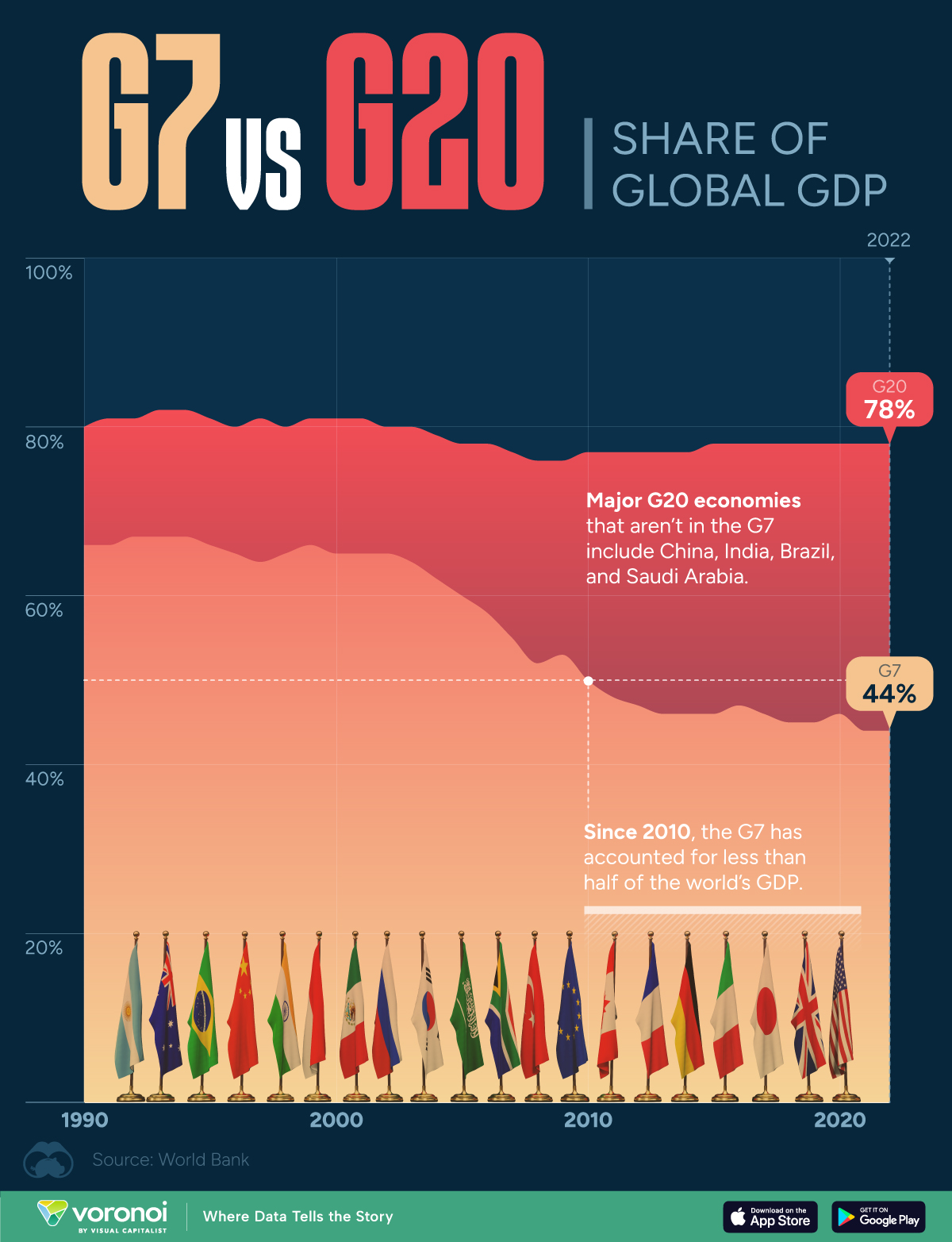

Charted: The G7’s Declining Share of Global GDP

![]()

See this visualization first on the Voronoi app.

Use This Visualization

Charting the G7’s Declining Share of Global GDP

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.