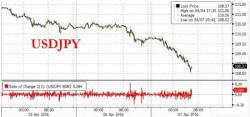

USDJPY Crashes, Drags Equities With It As Gold Soars

Ever since the USDJPY breached the 110 support level three days ago for the first time in 17 months, the pressure on this all important FX carry cross has been rising, and then overnight, following the latest bout of recurring and increasingly ignored jawboning by various Japanese officials, the Yen soared, with the USDJPY plunging first below 109 and then moments ago dropping as low as 108.02 before rebounding modestly, dragging US equity futures lower with it.