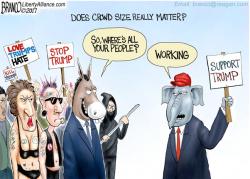

"It's Unfair" - Hispanic Workers Upset After Being Fired For Absence On "Day Without Immigrants"

The manager of the ironically named "I Don't Care" Bar and Grill in Catoosa, Oklahoma is hiring...

http://www.facebook.com/plugins/post.php

After firing 12 staff last week for violating his “no call/no show” policy.

http://foxbaltimore.com/embed/news/nation-world/catoosa-restaurant-fires-12-workers-for-not-showing-up-on-day-without-immigrants

Fox Baltimore reports that the workers are without a job after getting fired for skipping work as a show of support for “A Day Without Immigrants.”